Key Insights

- Analysts predict an incoming altcoin rally yielding as much as 250x in returns.

- The ETH/BTC ratio serves as a key indicator of altcoin outperformance. A potential breakout could signal the beginning of a new altseason.

- Chart patterns similar to the 2017 and 2020 altcoin booms are emerging.

The crypto market is heating up once again. Analysts are starting to sound the alarm for what could be a major altcoin rally. This rally could become one of the biggest, and Ethereum’s performance against Bitcoin could be the trigger.

Several crypto analysts say Ethereum may be on the verge of a major breakout. If history repeats itself, this could lead to another mega “altseason” similar to what we saw in 2017 and 2020.

Some even predict returns as high as 250x across the altcoin space if the current technical patterns hold up.

ETH/BTC As the Market’s Leading Indicator?

In crypto, market cycles often swing between Bitcoin dominance and altcoin outperformance. One of the most reliable indicators used to predict these transitions is the ETH/BTC ratio. Think of this as a measure of Ethereum’s performance relative to Bitcoin.

When Ethereum gains strength against Bitcoin, it often shows a change in investor appetite toward higher-risk assets. This is when altcoins flourish.

Crypto analyst Trader Tardigrade noted that Ethereum is nearing a breakout. It may soon exit its long-term consolidation range against Bitcoin.

The last time this happened in the 2020–2021 cycle, altcoins exploded, and many rose by over 2,500%. If Ethereum starts another upward trend against Bitcoin, it could serve as a major signal that alt season is ahead.

Analysts Spot Patterns That Mirror Previous Altcoin Booms

It’s not just one voice calling for an altcoin breakout. Multiple analysts are pointing towards patterns similar to those seen before the epic rallies in 2017 and 2020.

For example, crypto analyst Sensei pointed to a long-term trendline, which compares the total altcoin market cap to Bitcoin’s. Each time this trendline has held firm as support, it has led to massive gains of up to 180,000% in some cycles.

Sensei believes we could see another similar event: the altcoin market could enter a staggering 250x surge. While these figures seem slightly ambitious, they are not entirely without cause.

Altcoins have historically posted some of the most jaw-dropping returns in crypto, especially when retail investors jump in en masse. Another analyst, Moustache, pointed out that altcoins are now breaking out of a massive seven-year falling wedge pattern.

This technical setup happened before the altcoin booms of 2017 and 2020. It is another indicator that a rally could be brewing.

Ethereum’s Short-Term Struggles Could Delay the Party

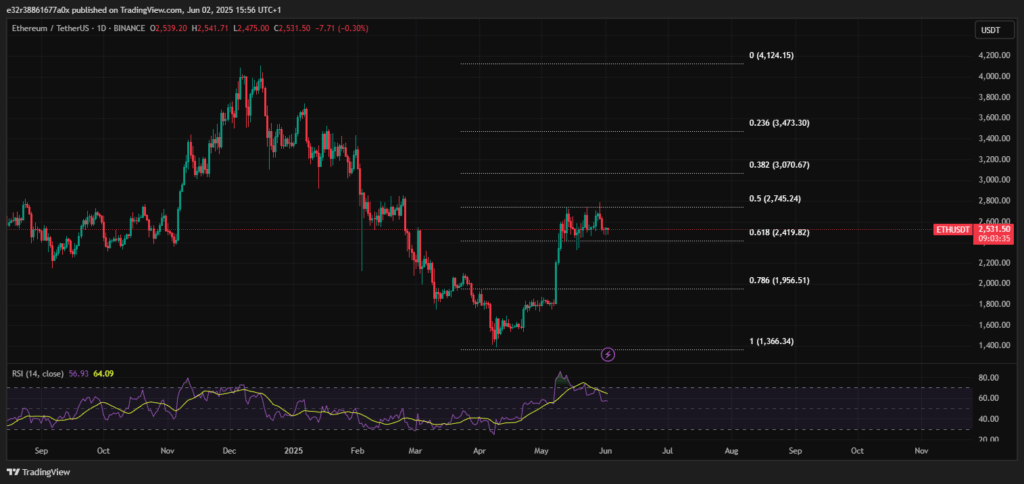

Despite the optimism for long-term gains, Ethereum is facing short-term issues that could delay the next altcoin season. On June 1st, ETH saw a sharp drop below the $2,500 level.

The cryptocurrency fell from $2,551 to $2,499 amid unusually high trading volume. There, over 48,000 ETH were traded in under two minutes. Such a sell-off is speculated mainly to be due to holders, maybe even institutions, dumping their positions.

While the price has stabilized around $2,506, the $2,500 zone remains a fundamental support level. So far, analysts are watching, and if Ethereum holds this level, it could invite new buyers and help restore momentum.

On the flip side, if a break below occurs, ETH could face further losses and drag the rest of the altcoin market down, possibly to $2,000. That said, long-term sentiment in the crypto market is still very bullish.

Many still believe the groundwork is being laid for the next major cycle, where altcoins could massively outperform once again.